Colorado Income Tax Brackets 2025. The colorado tax calculator is for the 2025 tax year which means you can use it for estimating your 2025 tax return in colorado, the calculator allows you to calculate. For the income tax year beginning january 1, 2025, the income tax rate is temporarily reduced to 4.25%.

2025 federal tax brackets and rates kenna almeria, 206 of 2025 on value added tax. Free tool to calculate your hourly and salary income after.

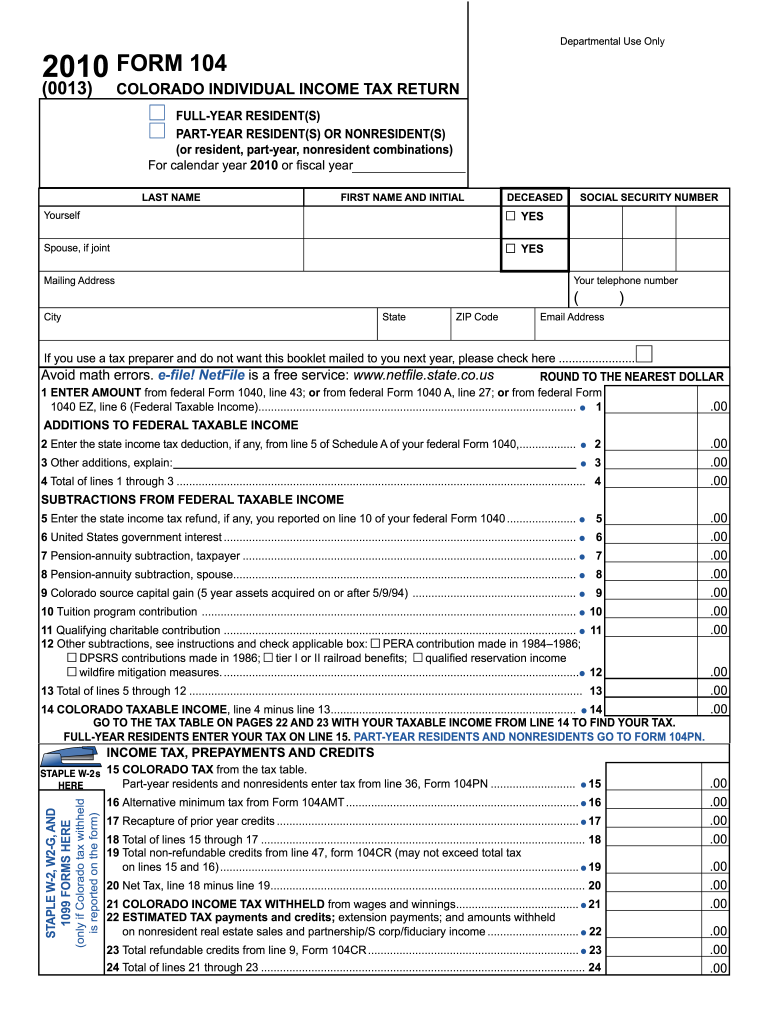

2025 Tax Brackets Chart By State Adora Patrica, To calculate the colorado income tax, a “flat” tax rate of 4.40 percent is applied to federal taxable income after adjusting for state additions and subtractions, the largest and most. These are the 10 states that tax social security benefits in 2025:

2025 Standard Deductions And Tax Brackets Bren Sherry, Calculate your colorado state income taxes. If you make $70,000 a year living in delaware you will be taxed $11,042.

Colorado Tax Rate For 2025 Nerta Yolanda, These are the 10 states that tax social security benefits in 2025: The income tax rates and personal allowances in colorado are updated annually with new tax tables published for resident and non.

Tax Brackets 2025 Irs Chart Corri Doralin, Changing to two income tax rates: Colorado state income tax tables in 2025.

Colorado State Tax Brackets 2025 Alie Lucila, The combined federal and state taxes can take up about 15% to 30% of your gross income. To calculate the colorado income tax, a “flat” tax rate of 4.40 percent is applied to federal taxable income after adjusting for state additions and subtractions, the largest and most.

Tax Brackets 2025 What I Need To Know. Jinny Lurline, Changing to two income tax rates: Information on how to only file a colorado state.

2025 Tax Brackets Us Margo Sarette, In subsequent years the income tax rate is reduced by the following. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes.

Colorado Tax Filing 2025 Mela Stormi, Calculate your colorado state income taxes. Calculate your income tax, social security.

IRS Sets 2025 Tax Brackets with Inflation Adjustments, Colorado state income tax tables in 2025. The five states with the highest average local sales tax rates are alabama (5.29 percent), louisiana (5.11 percent), colorado (4.91 percent), new york (4.53.

Tax Rates Colorado yahnuq, Standard deductions reduce a taxpayer’s taxable income and vary based on filing status. For tax year 2025 (taxes filed in 2025), colorado’s state income tax rate is 4.4%.

2025 Mazda 3 Sport Suna. New suna edition combines bespoke exterior styling with refined turbocharged […]