Corporate Tax Rate Singapore 2025. China’s antfin singapore pte will be selling 13.6 crore shares or over 1.5 per cent stake in portfolio firm zomato in a block deal, according to a term sheet. After the latest transaction, if it goes through, antfin singapore holding pte's shareholding will reduce to a 2.76 percent stake in zomato from a 4.3 percent stake (as of.

Time technoplast is sbi securities’s ‘top pick of the week’ after a 121% surge in 2025 ytd; Current singapore corporate tax rate.

Guide to Corporate Tax in Singapore 2025 Optimizing Tax Strategies A, You take care of business.

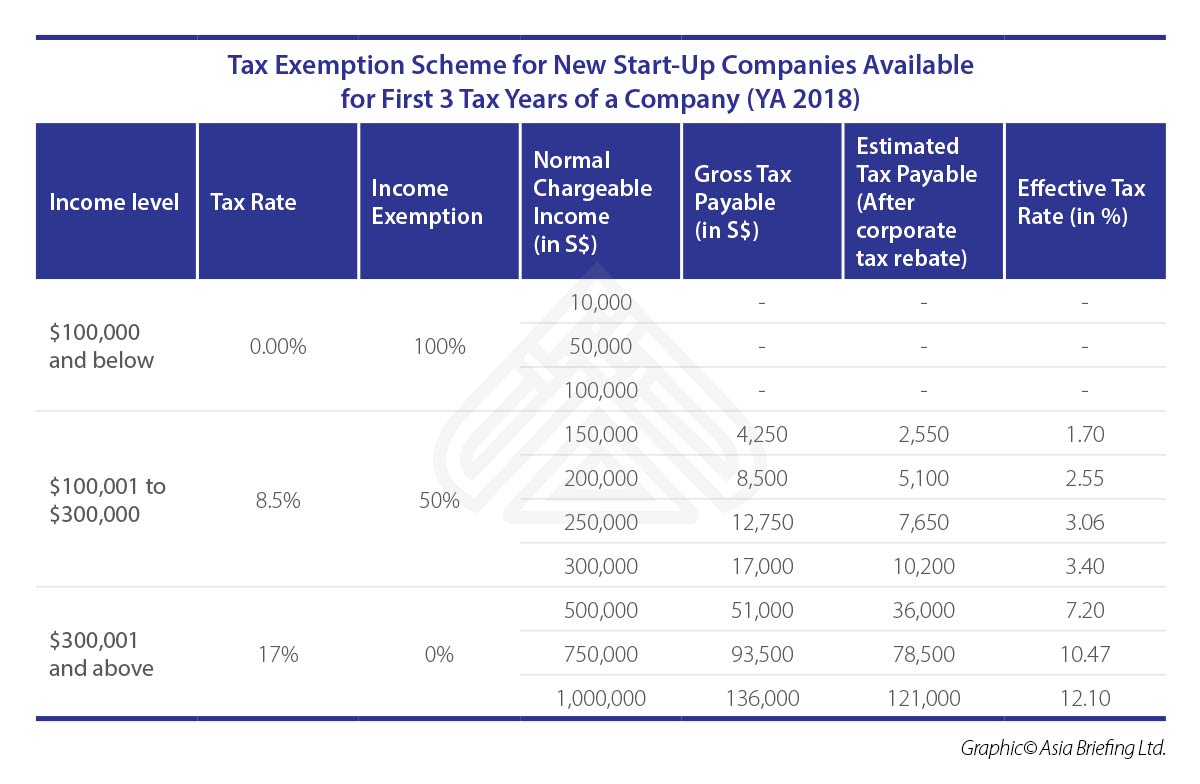

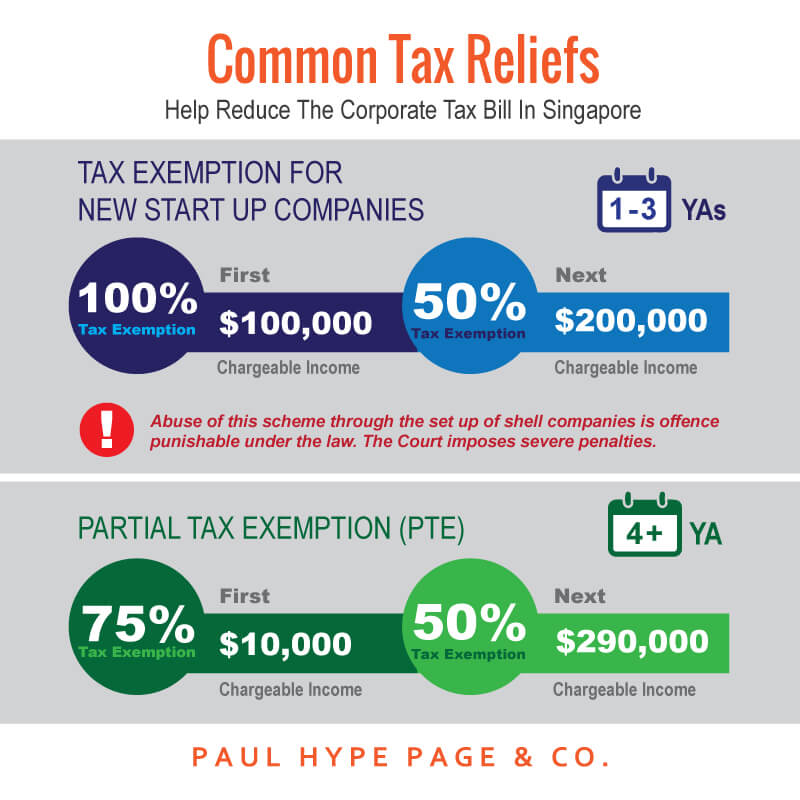

Singapore Corporate Tax Rate slideshare, With effect from 17 february 2025, an additional concessionary tax rate (ctr) tier will be introduced for the following tax incentives:

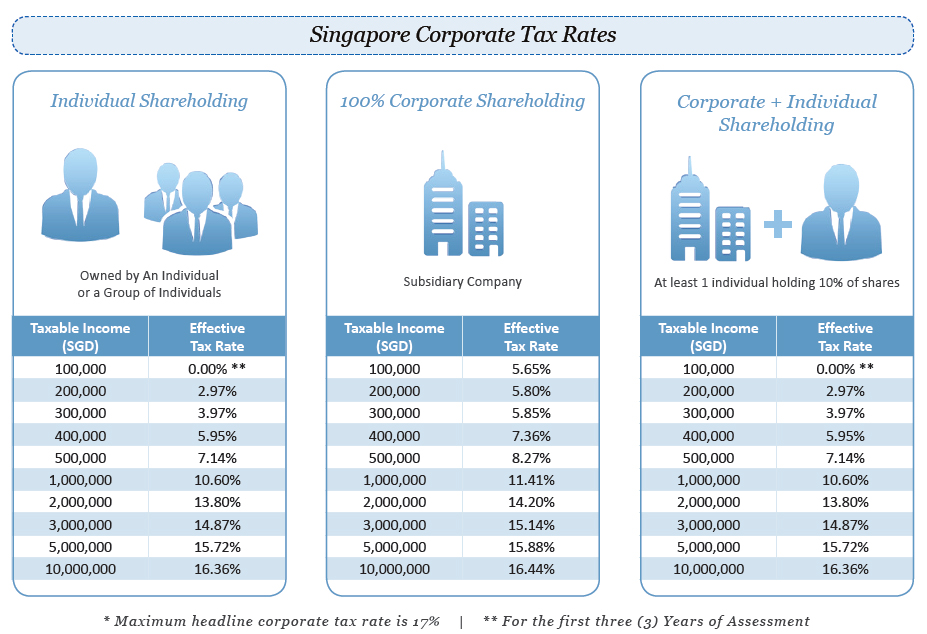

Asiapedia Singapore's Corporate Tax Quick Facts Dezan, Corporate tax rate in singapore averaged 19.61 percent from 1997 until 2025, reaching an all time high of 26.00 percent in 1998 and a record low of 17.00 percent in 2010.

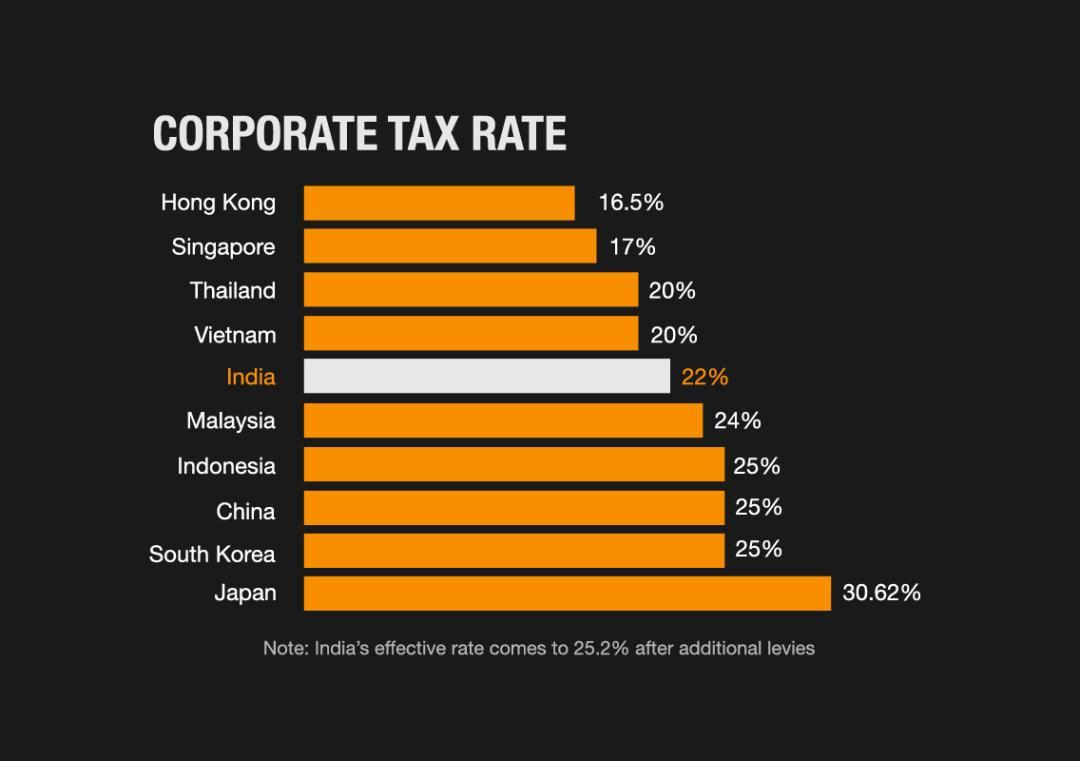

Doing Business in Singapore vs. India Comparative Report, China’s antfin singapore pte will be selling 13.6 crore shares or over 1.5 per cent stake in portfolio firm zomato in a block deal, according to a term sheet.

Essential Guide to Reducing Corporate Tax in Singapore A Book Of Finance, Corporate tax rate in singapore averaged 19.61 percent from 1997 until 2025, reaching an all time high of 26.00 percent in 1998 and a record low of 17.00 percent in 2010.

Facts About Corporate Taxes in Singapore Singapore Taxation, File your corporate tax returns with singapore.

Uncover Strategies to Optimize Corporate Tax Rate Singapore A Book Of, Corporate income tax (cit) rebate and cit rebate cash grant for year of.

singapore tax rate Singapore Personal Tax Rates hamcisko, A ctr of 15% for the global trader programme,.

Uncover Strategies to Optimize Corporate Tax Rate Singapore A Book Of, Tax on corporate income is imposed at a flat rate of 17%.